The

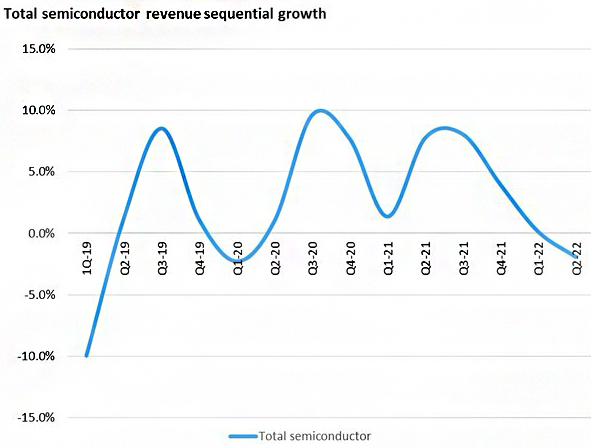

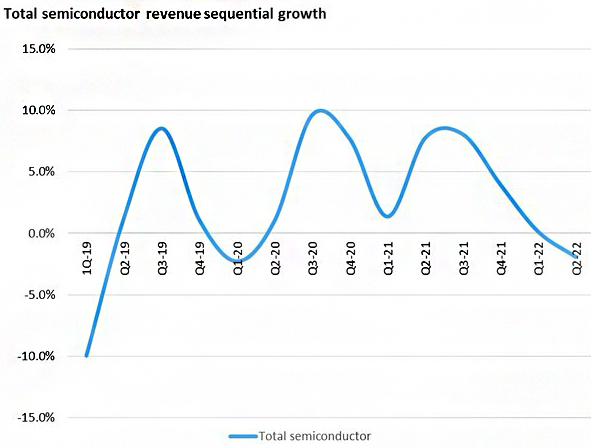

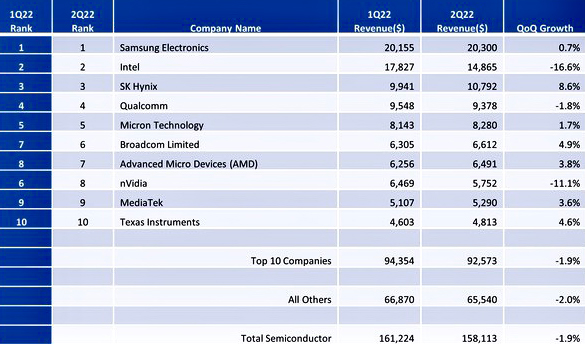

semiconductor market revenue in the second quarter of 2022 was US$158.1

billion, down 1.9% from the first quarter of 2022. Prior to this, the

semiconductor industry has grown for eight consecutive quarters, the longest

streak on record.

The combined influence of

multiple factors dragged down the Q2 market

Cliff Leimbach, senior Research analyst at Omdia, said: ‘Semiconductor

market revenue declined in the second quarter of 2022, making it the third-worst

second quarter performance in the 20 years Omdia has tracked the market. Given

the cyclical nature of the semiconductor market, we expect the market to return

to normal after the first half of 2023.’

One factor contributing to the current decline in the

semiconductor market is Intel's second-quarter 2022 results and a 13% decline

in the company's microprocessor (MPU) business in the first quarter. The size

of the MPU market accounts for more than 10% of the entire semiconductor

market, so the sharp decline in this market has dragged down the overall market

performance.

In addition, companies reporting revenue in other

currencies saw revenue decline when converting data to U.S. dollars, as the

U.S. dollar began to strengthen in the second quarter of 2022. The combination

of these factors has had a downward impact on the total semiconductor market

revenue in dollar terms.

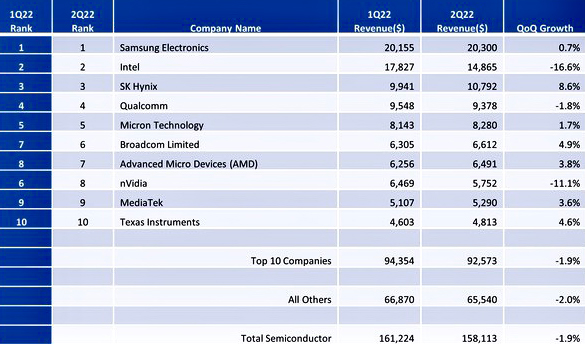

Top 10 manufacturers: only

two have double-digit revenue declines

Among the top 10 semiconductor companies, Intel and Nvidia

have combined to reduce revenue by $3.7 billion in the second quarter of 2022. This

is due to weak consumer demand and lower inventory levels by OEMs amid an

uncertain outlook. Apart from these two companies, only Qualcomm and

NVIDIA experienced a revenue decline in the second quarter among the top 10

semiconductor companies, and the rest of the companies saw revenue growth in

the quarter.

For the memory market, there was a slight increase in the

second quarter, up just over 1%. As the world's largest DRAM and NAND

manufacturer, Samsung Electronics' second-quarter semiconductor sales reached

$20.3 billion, an increase of $145 million from the first quarter, under the

combined force of memory market growth and Intel's declining performance. Omdia

attributed the increase to continued demand for server semiconductors and

higher system semiconductor (non-memory) sales.

Samsung Electronics' market share rose 0.3 percentage

points to 12.8 percent of 12.5 percent, expanding its lead over Intel to 3.4 percentage

points. However, this South Korean semiconductor giant may lose its lead in the

second half as the memory semiconductor market is entering a recession.

Intel's

second-quarter revenue was $14.865 billion, down 16.6% from the first quarter.

Intel posted a net loss of $454 million in the second quarter due to a slowdown

in PC demand due to the economic downturn and supply chain disruptions.

This article refers to the comprehensive report of "International Electronic Business".